VCs see a ton of startups. All vying to get them to open up their purse strings. Since most startups will fail it can be difficult, for VCs, to find one they can successfully project will succeed. That’s where due diligence comes in.

Normally, a VC’s due diligence requires entrepreneurs to thoroughly research the market and demonstrate the potential for growth while including factors like the size of the market, strength of competitors, barriers of entry, and so on. Basically, they want to see you’ve done your homework.

You already know why you need to do market research so I’ll skip past answering “why”. The “How” is a lot murkier. That’s because market research is usually performed by large companies who hire companies like Forrester or Gartner and have a horde of analysts at their disposal querying large data warehouses from which they can pull info and create comprehensive, and very expensive, industry reports.

But, we can’t afford the time it takes to do that, and we definitely can’t afford the hefty price tag. Most early-stage startups don’t have the budget to contract a Forrester or a Gartner and are forced to scrap, workaround, and hustle for their data. Now, there’s absolutely nothing wrong with an entrepreneur hustling to get what they need but even entrepreneurial hustles should have best practices.

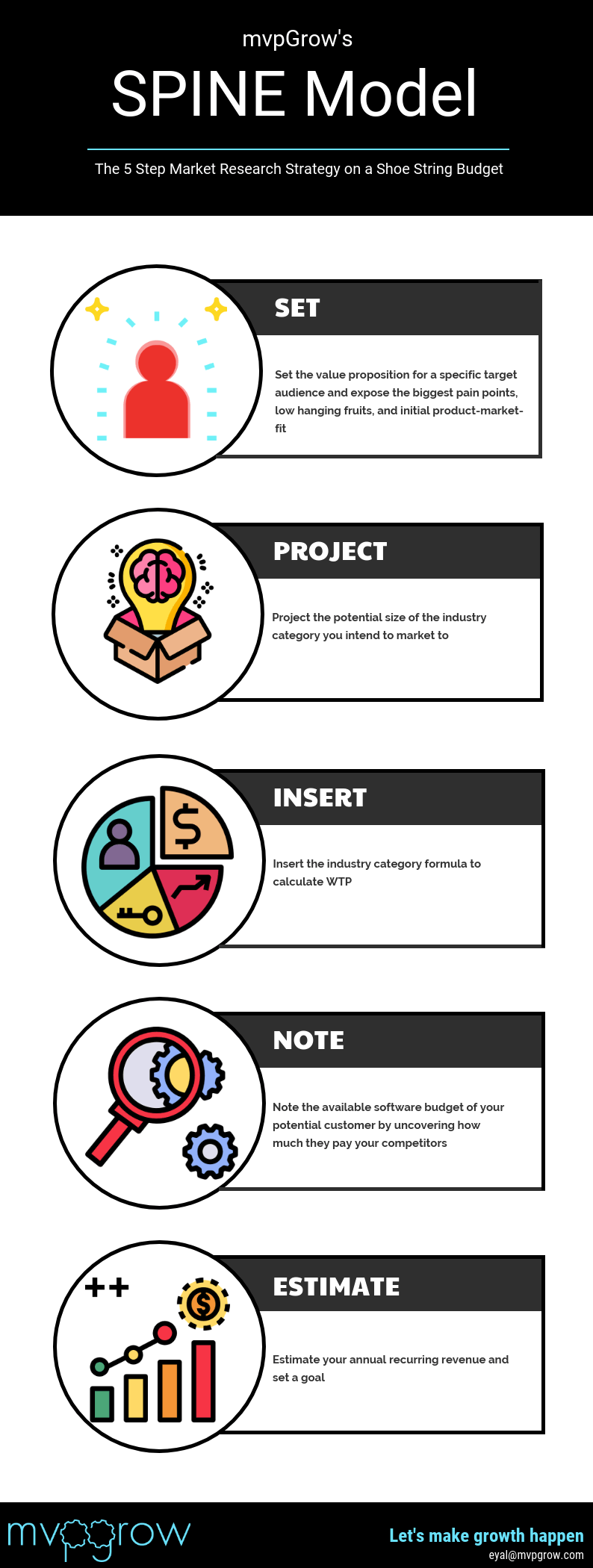

Fortunately, after about 7 years of hustling for market research data, I’ve come up with a 5 step market and competitor research methodology for B2B companies that I call The SPINE Model.

The great thing about the SPINE Model is that it won’t require spending more than $500 on tools (at most) and still provide you with the basics you need to figure out the size of the target audience, generate a value proposition for said audience, ballpark and estimate market share, calculate Willingness to Pay (WTP), and create a data driven ARR KPI without having any data. The five steps of the SPINE model are:

- Set the value proposition for a specific target audience (Part 1)

- Project your industry size (Part 1)

- Insert the industry category formula to calculate WTP (Part 1)

- Note the available software budget of your potential customer (Part 2)

- Estimate your annual recurring revenue and set a goal (Part 2)

How do I figure out the size of my audience?

If you want to raise money, heck, even if you don’t, you need to know what the potential of your business is as early as possible. Imagine, you find a perfect solution to a problem but you then find out it’s only a problem to a few hundred people. It probably wouldn’t make sense to spend a lot of time and money developing a solution for it.

However, if you discover a problem potentially impacting millions of businesses and people worldwide that no one has solved. Then, validating your audience and value proposition should be your first step.

1. Set Value Proposition and Target Audience

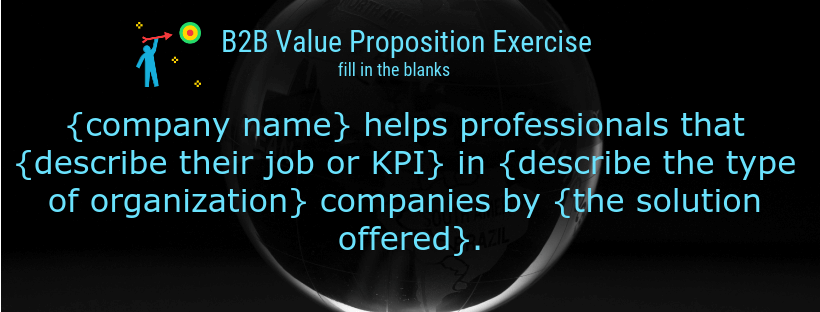

Let’s start with an exercise I use to figure out the target audience for a B2B product.

Fill in the blanks: {company name} helps professionals that __(describe their job or better yet their KPI)_________ in ____(describe the type of organization)______ companies by ____(the solution you offer)________.

Let’s run this exercise on what was likely Wix’s early stage value proposition: “Wix helps small businesses in non-digital industries by providing a free and easy to use platform to create a great looking website”.

Not very catchy, right?! But, that’s ok. The purpose of this exercise is not to create a tagline or ad copy but to map out the target audience and value proposition.

Let me give you another example from the startup I worked at, AdNgin: “AdNgin helped professionals who monetize content with ads and work for digital publications by providing them an a/b testing tool to create page layouts that increase revenue while improving the user experience.

Try to refrain from using job titles and industry verticals. These are meant to help us silo and categorize but, when mapping out the target audience, also have an adverse effect of limiting the audience by categories and not by a shared need or problem.

In the AdNgin example from above, this exercise was instrumental in understanding who the right target audience was, who has the biggest pain we can solve, and who can be considered the low hanging fruit with most immediate product-market-fit.

Sometimes, a simple exercise like this one can provide the added benefit of discovering new verticals and expanding your cap beyond what you previously thought, which is exactly what VCs want to see when you’re raising capital.

2. Project My Industry Size

Once you have your target audience and basic value prop down it’s time to discover just how big of an impact you can make with your new and disruptive (love this word) product. VCs already know your industry size, more or less, but they want to hear your estimate. So how do you provide a pretty accurate estimate when you don’t have the budget to hire a Forrester or a Gartner?

Let’s say you wanted to launch an ad server designed for digital publishers and you wanted to estimate the size of the AdTech market for publishers.

AdTech is an industry that receives a lot of interest from the press as well as research companies. This makes your job much easier. Or does it?!

The IDC, estimated the AdTech market at $12.7B for 2017 and is expected to grow by 7.8% by 2022. So there you have it, $12.7B is the size of the AdTech industry.

However, you’re building software for publishers only. In addition, the IDC’s estimate includes the duopoly of Google and Facebook, which isn’t going to be a customer since they’re not a classic digital publisher. This makes the process of accurately estimating your actual market cap more challenging than it may appear.

What is an industry category?

When it comes to performing market research, one of the biggest challenges that entrepreneurs face that research firms don’t necessarily map out industries in a way that is relevant and useful. For example, the AdTech industry lumps into it advertiser solutions, publisher solutions, and ad networks.

Not every solution will be relevant for all three industry categories. Therefore, when performing market research, and trying to estimate the potential annual revenue for your solution, you can’t use revenue estimates provided for an entire industry. You’re going to need to find out and analyze the annual revenue of the industry category that is relevant for your offering.

How do we accurately estimate the size of our industry category?

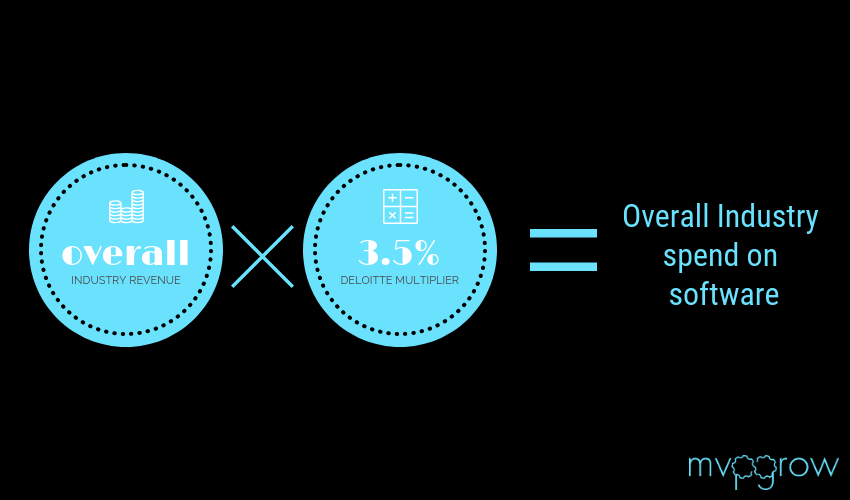

First, back to our ad servers example, ad servers are still mostly used to display the right ads to the right audience on the right website in a split of a second. In addition, the size of the (programmatic) display advertising market in the US for 2018 was a little over $39 billion (Note: this does not include the duopoly of Facebook and Google). Third, according to Deloitte, most companies will spend about 3.28% of revenue on software, with media companies spending about 4.5% of revenue on software.

What do all these numbers mean?! We can use the above example to more accurately estimate the size of your target market by following this formula:

(Industry revenue total) x 3.5% (the avg. amount spent on B2B software) = amount spent on software for an industry

In the above example, if our target is large publishers in the US then our potential market size is:

$39 billion x 3.28% = $1.28B

Therefore, if you’re going to build and market your own publisher side ad server you can expect the size of the market to be about $1.28B.

Here’s the step by step:

- Estimate the size of the industry (by revenue) that your software solves for (digital marketing, multi-home property management, commercial construction, software sales, Telecom, etc.)

- Use the Deloitte multiplier to understand what percentage of an industry’s revenue is used to purchase software

- Hit the easy button!

3. Insert the Industry Category Formula to Calculate WTP (Willingness to Pay)

This very simple formula is also great for calculating the Willingness to Pay (WTP). Willingness to pay is basically how much are is a potential customer, from your target audience, willing to pay for your solution on average.

For example, if a medium sized publisher’s revenue is about $20 million / year then, conceivably, they can afford to spend $656,000 a year on software (based on our formula).

Back to our AdTech example, a publisher’s tech stack has to include, among other things, stuff like servers, development environments, and marketing technology. There is not much left in the software budget for our ad server.

Actually, we can use tools like the free versions of Datanyze or SimilarTech to discover what’s on a certain website’s tech stack. Then, in order to understand just how much they have left in their budget (if at all) for our ad server, we just need to estimate how much they’re paying for their SaaS software, which in most cases shouldn’t be too difficult to find out.

In the past, this method has led me to find that most of mid tier digital publishers and eCommerce companies I examined had about 15% of their software budget available to play with.

Keep in mind, we’re not necessarily logical creatures, which makes it difficult to boil down purchasing decisions to a formula, even in a B2B setting. In part 2, I will cover the several factors that go into calculating WTP that require us to turn our gaze away from own product and consider stuff like competitor pricing, competitor churn rates rates, and average lifetime value.

Let’s recap

Market research is a key part of any startup’s strategy, regardless of stage. Since “the market” isn’t a statically defined set of criteria, and neither is your product, then market research findings can and often do change. That’s why you should be doing periodical market research repeatedly.

Now, if you don’t have a budget for an expensive research company there are still ways to perform effective market research. First, define your product market fit by elucidating your value proposition and unique selling point. Second, once you have your target audience defined you can estimate its size by figuring out the market share of the top competitors in the field. Third, you take the industry category formula to calculate your audience’s willingness to pay.

And Bob’s your uncle, you have generated a value prop and USP, calculated the size of your audience, and also figured how much to price your solution for – all under $500 with enough change to treat yourself to a burrito or a two.

In part 2, I will cover the two final steps of the SPINE model that will uncover your competitors’ strategies and allow you to estimate a customer’s software budget, stay ahead of the market by predicting market trends, introduce competitor data to your WTP calculation from above, and, finally, predict your overall ARR.

UPDATE: Part 2 is now live.

The Founder & Chief Getting Sh%T Done Officer of mvpGrow. After about 8 years as a hired hand some of the largest (and smallest) B2B SaaS companies worldwide I decided to hang up my employee slippers and lace up my growth agency cleats. But just because I’m an agency doesn’t mean we can’t chat (no charge). Please email me on any topic and I will gladly reply: eyal@mvpgrow.com