Fintech is reshaping how individuals and businesses handle their finances. Digital wallets, robo-advisors, and embedded finance have evolved from buzzwords into practical tools that streamline everything from routine payments to complex investments. But with so many options on the market, even the most promising fintech solutions risk getting lost in the shuffle without a clear marketing strategy.

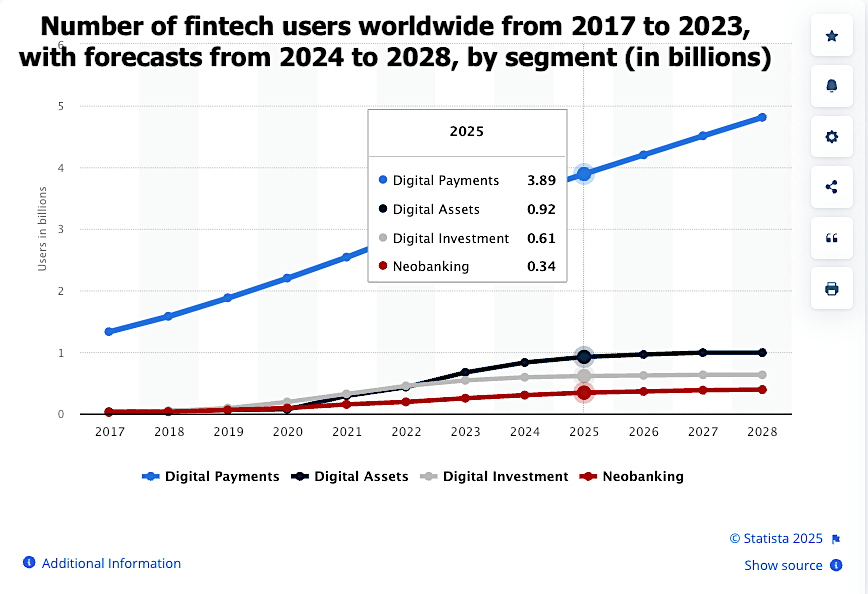

The scale of the market becomes apparent when you consider that 5.76 billion people will be using fintech apps in 2025—an increase of nearly half a billion from 2024. Not only is there a growing appetite for digital financial products, but there’s a wave of new fintech companies vying for attention. Standing out in such a crowded space demands consistent, credible communication that resonates with the real-world financial needs of potential customers.

To succeed, fintech companies need a robust product backed by a specialized marketing blueprint that prioritizes transparency, compliance, and user insights to earn genuine trust. In an industry defined by fast-paced innovation and stringent regulations, a bulletproof fintech marketing strategy can make all the difference.

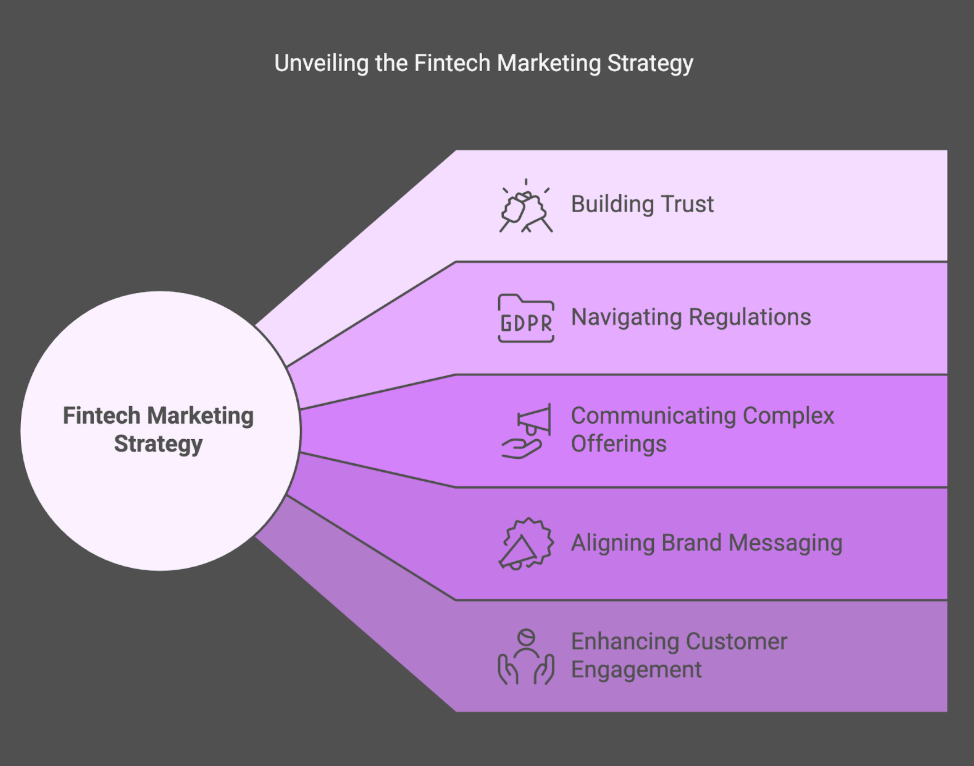

What is a fintech marketing strategy, and why do you need one?

A fintech marketing strategy is a niche-focused plan that helps financial technology companies connect with their audience, showcase their products, and comply with relevant regulations.

Unlike standard marketing strategies, it zeroes in on the unique demands of fintech, which includes everything from building trust in new payment models to navigating strict legal frameworks. It’s designed for marketing teams that must clearly communicate complex offerings while reassuring regulators and end users.

The question is, why do you need a fintech marketing strategy? The fintech space is filled with fresh ideas, and people want proof that these solutions are reliable before jumping on board. A well-rounded strategy highlights core features and also shows how they address security and compliance issues.

When properly implemented, a fintech marketing strategy aligns brand messaging, product positioning, and customer engagement to give companies a competitive edge. It’s especially crucial for startups and marketing leaders who need to build brand credibility, forge strong partnerships, and rapidly adapt in a rapidly evolving sector.

Benefits of a Fintech Marketing Strategy

Regulatory Clarity

A fintech-specific strategy helps you navigate strict (and ever-changing) regulations, such as GDPR (General Data Protection Regulation) or PSD2 (Payment Services Directive), to ensure your messaging, product claims, and user onboarding all stay compliant.

Trust through Security

Fintech handles sensitive data and transactions. A fintech marketing plan showcases your solution’s robust data security measures, which is essential for convincing users that your product is safe and reliable.

Education in New Financial Concepts

Features like robo-advisors or embedded finance can be unfamiliar to many. A strategy that focuses on clear, simple explanations helps potential users see the everyday value of financial tech tools.

Credibility in a Crowded Market

A fintech marketing strategy sharpens your brand’s unique selling points so your solution gains credibility and doesn’t fade into the crowd of competitors.

User-Centric Approach

Fintech customers crave personalized experiences and transparent communication. A strategy built for fintech emphasizes empathy, clarity, and responsiveness at every user touchpoint.

The 8-Step Blueprint for a Successful Fintech Marketing Strategy

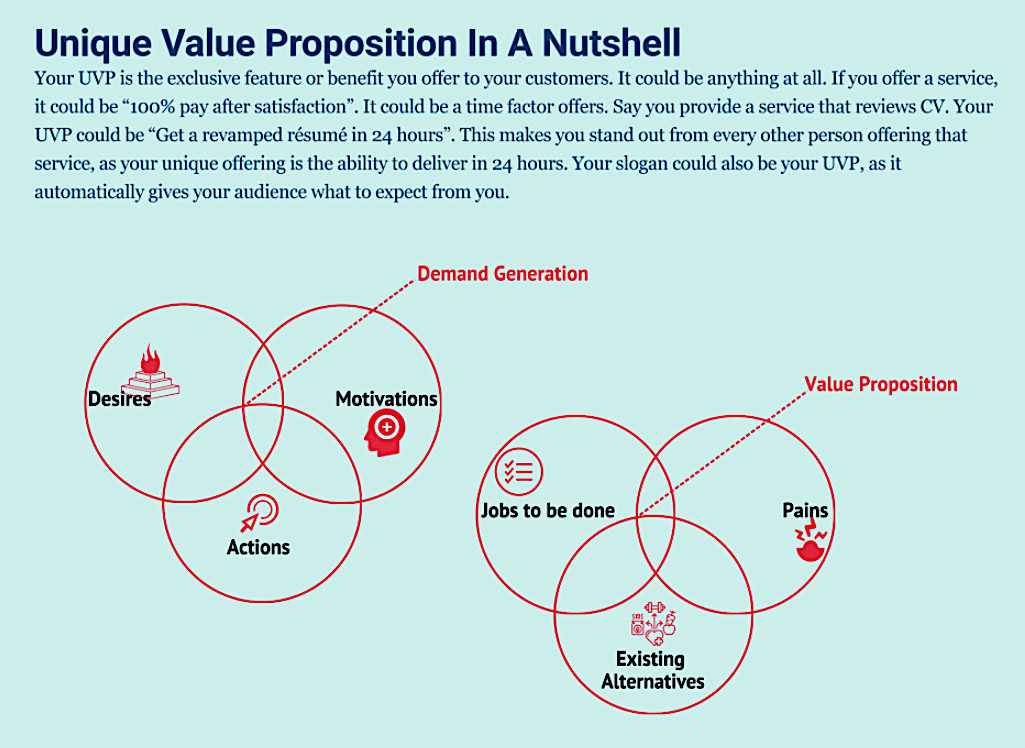

1. Define Your Unique Value Proposition (UVP)

Your UVP is the foundation of everything you do in fintech marketing. It pinpoints exactly which problem you solve, like speeding up transactions, enhancing security, or reducing overhead for users. Clarity about your offering sets you apart from countless competitors.

Fintech users—whether businesses or individual consumers—deal with sensitive financial data every day. They want reassurance that your solution is reliable, compliant, and genuinely useful. When your UVP highlights these elements, you’re more likely to earn trust in a crowded marketplace.

Pro Tips:

- Think about the top pain points in finance, like lengthy processes, security concerns, or hidden fees—and directly address them.

- Frame your UVP in a way that shows how your solution makes life simpler or safer.

- Keep it concise, and ensure everyone on your team knows how to communicate it.

2. Identify and Segment Your Audience

Fintech users aren’t one-size-fits-all. A Gen Z student looking for budgeting tools has different needs than a CFO scouting more efficient cross-border payments. Segmenting your audience enables your marketing campaigns to deliver focused messages that resonate with each group’s specific concerns.

In fintech, regulations, user behaviors, and financial goals differ vastly across demographics. Proper segmentation helps you avoid generic campaigns that fail to speak to anyone in particular. Instead, you can customize your approach based on each segment’s pain points and preferred channels.

Pro Tips:

- Create 3–5 customer personas reflecting your most relevant user groups, such as small business owners, individual investors, or corporate decision-makers.

- Use analytics and AI-driven insights to refine these personas over time.

- Align each audience segment with targeted campaigns so you can speak to their exact challenges.

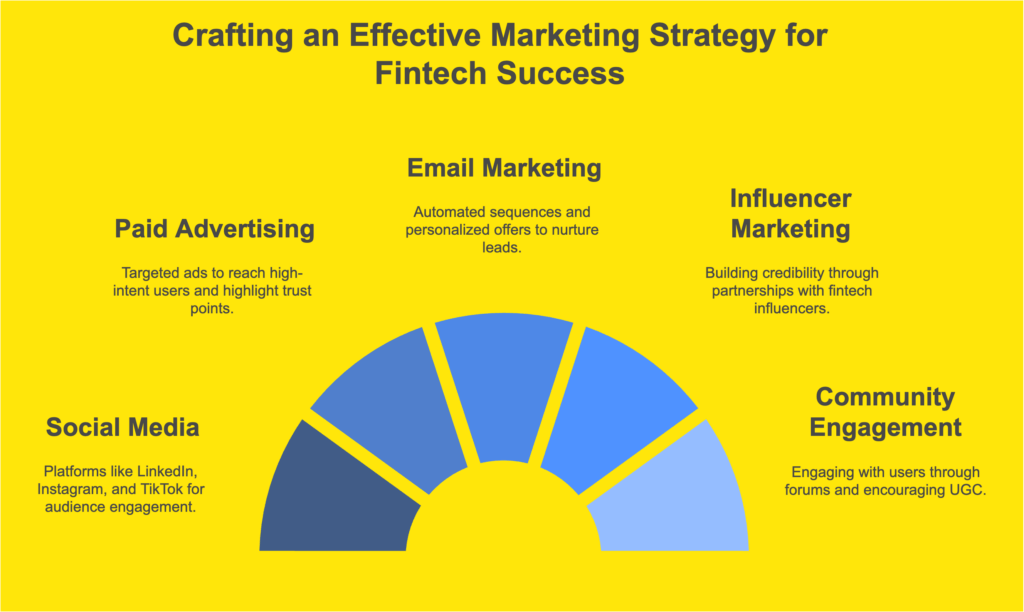

3. Leverage the Right Marketing Channels

Choosing the right marketing channel is critical to meeting your audience where they spend time online. A B2B fintech firm might find success on LinkedIn, while a consumer-facing payments app might flourish on Instagram or TikTok. Here’s a closer look at each channel type and how to leverage it:

Social Media

- LinkedIn is ideal for building relationships with corporate decision-makers, compliance professionals, and other B2B audiences. Share thought leadership posts or case studies that demonstrate real-world value.

- Instagram and TikTok are most effective for grabbing the attention of younger, tech-savvy users. Keep content short, visual, and engaging.

Paid Advertising

- Programmatic ads can target high-intent users based on their online behavior.

- Retargeting also works well, especially if people have visited your pricing page or partially completed a sign-up.

- Highlight fintech trust points like security features, quick onboarding, or transparent fees to make every ad count.

Email Marketing

- Automate onboarding sequences to guide new users through setup.

- Share tutorials or FAQs to help them get more from your platform.

- Employ drip campaigns to nurture leads over time.

- Personalized offers (such as free credits or educational webinars) are great for keeping current customers engaged.

Influencer Marketing

- Partnering with fintech-focused influencers or bloggers can build credibility quickly. Just ensure their audience aligns with yours before investing resources.

Community Engagement

- Host Q&A sessions on fintech forums or Reddit to answer questions and show you’re accessible.

- Encourage user-generated content (UGC) from employees and customers like reviews or success stories to build loyalty and authentic advocacy.

Pro Tips:

- Lean on your customer personas to determine what channels your prospects use.

- Start small by testing one or two channels that fit your primary audience best.

- Track open rates, click-through rates, or other key metrics, then scale your efforts where you see a measurable impact.

4. Build a Regulatory-Compliant Content Strategy

Fintech’s marketing strategy goes deeper than just talking about features and benefits; you must also meet legal and compliance requirements. This added layer means producing content that’s accurate, transparent, and easy to understand.

Financial regulations can vary by region, and any misstep could result in fines or a damaged reputation. At the same time, users want to feel confident that your product follows strict guidelines to ensure the security of their finances and personal data. Quality content that meets these standards shows professionalism and trustworthiness.

Pro Tips:

- Create educational resources like eBooks, blogs, or FAQs that break down complex financial topics.

- Use clear, jargon-free language that aligns with compliance guidelines.

- When discussing results or benchmarks, back them up with reliable data and proper disclosures.

5. Optimize for SEO with a Fintech Focus

In fintech, trust is non-negotiable. If people can’t find you in search results, they might never know you exist—much less trust your platform with their finances.

Fintech-focused SEO demands a deep understanding of what users worry about and the ability to address those concerns head-on. Your goals are to boost visibility while also reassuring potential customers that your solution is a dependable option in a marketplace where credibility is currency.

Keep in mind that potential customers often start with a search for “secure payment platforms” or “how to choose a robo-advisor.” If you’re not ranking for these kinds of keywords, you risk losing out to more visible competitors.

Pro Tips:

- Fintech search behavior often revolves around high-intent queries like “digital wallets” or “best crypto to buy now.” Create content clusters that dive deeper into each topic, and rank for a broader set of related keywords while demonstrating authority in your niche.

- Ensure your website is mobile-optimized. A responsive layout, quick loading times, and intuitive navigation are crucial to keep visitors engaged. Compress images and videos, leverage lazy-loading to speed up page loads, and reduce unnecessary redirects.

- Seek quality backlinks from reputable finance and tech sites. Consider guest blogging on platforms like Finextra or collaborating with fintech publications.

6. Personalize Using Data and AI

Data-driven personalization is a game-changer in fintech. From recommending the right insurance products to crafting custom loan offers, AI and machine learning let you customize user experiences like never before.

Personalization matters in fintech because users share sensitive information (like credit scores and spending patterns)—and then expect a more relevant outcome than they would from a generic service. Additionally, personalized features build confidence and keep users engaged longer.

Pro Tips:

- Use AI tools to group users by behavior (e.g., frequent transactions, high savings balances) and deliver targeted messaging—like tips for maximizing returns or notices about new deposit features.

- Use machine learning to anticipate user needs, like suggesting short-term loans for unexpected expenses or personalized investment strategies based on risk appetite, and provide timely, relevant options

- Make sure your privacy policy is transparent and your user consent practices are rock-solid to ensure users that their data is secure.

7. Build Thought Leadership in Fintech

Being seen as a credible voice can mean the difference between prospective customers passing you by or taking a closer look. Demonstrating thought leadership through industry reports, panel discussions, or in-depth articles positions you as an authority, which lends needed credibility to your solution.

It’s critical to remember that trust underpins every financial transaction. When you share meaningful perspectives on topics like regulation, blockchain, or future trends, you’re telling the market you’re a brand worth listening to.

Pro Tips:

- Start by publishing a regular blog series or short opinion pieces on LinkedIn.

- If possible, collaborate with industry experts for co-branded reports or webinars.

- Choose timely issues such as data privacy or emerging payment methods, and offer clear insights that others can act on.

8. Measure Success with KPIs and Analytics

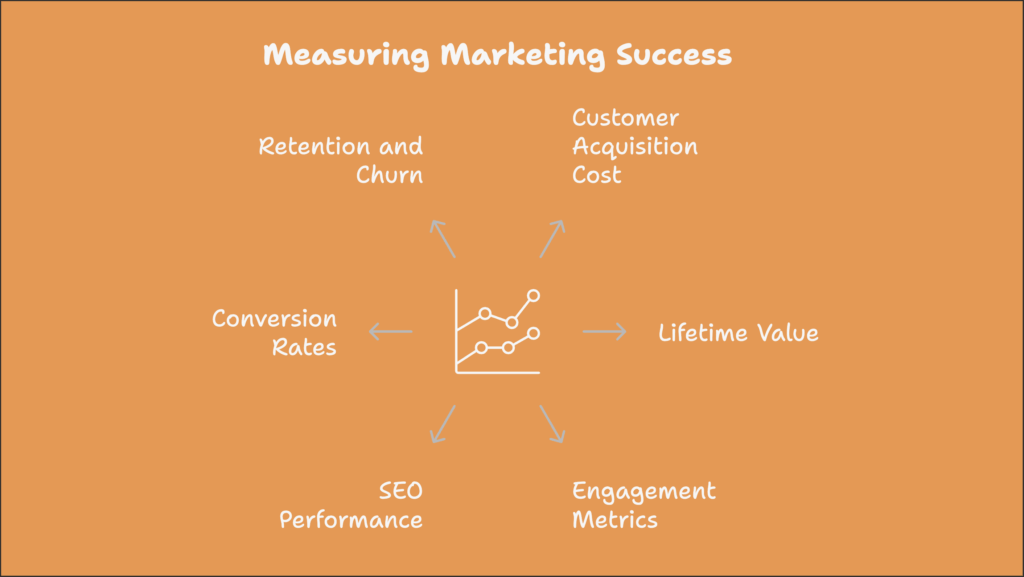

All the planning in the world won’t mean much if you can’t track and interpret results. Specific metrics help you see which marketing campaigns are working and where to pivot. Keep a close eye on these marketing success measurements:

- Customer Acquisition Cost (CAC) – How much do you spend to bring on each new customer?

- Lifetime Value (LTV) – Does each user eventually generate enough revenue to cover acquisition and service costs?

- Engagement Metrics – Look at email open rates, click-through rates (CTR), or time on page to gauge interest.

- SEO Performance – Track your rankings for crucial keywords and monitor organic traffic.

- Conversion Rates – Measure how many visitors become trial users, download your app, or complete a purchase.

- Retention and Churn – Watch how many users stick with you over time versus those who drop off.

Pro Tips:

- Use platforms like Google Analytics or HubSpot to create dashboards for these KPIs.

- Review the data regularly, either weekly or monthly, depending on your scale.

- Refine your strategy by making changes if a key metric starts lagging or double down if it shows improvement.

Create a Winning Fintech Marketing Strategy with mvpGrow

Implementing this eight-step blueprint requires commitment, but the payoff is a fintech marketing engine that’s responsive, credible, and built for long-term growth. Focusing on specific fintech nuances like compliance, trust, and personalization will leave you better positioned to connect with prospects that demand transparency and real value.

Whether you’re a fintech startup launching your first platform or an established brand looking to branch into new markets, mvpGrow helps B2B organizations build marketing strategies that fuel sustainable success.

Our global expert team helps your brand grow with a full range of services, including lead generation, SEO, content marketing, and campaign management. Guided by data and real-world insights, we offer a marketing department as a service approach tailored to meet your fintech company’s unique goals and challenges—so you can stand out and thrive.

The Founder & Chief Getting Sh%T Done Officer of mvpGrow. After about 8 years as a hired hand some of the largest (and smallest) B2B SaaS companies worldwide I decided to hang up my employee slippers and lace up my growth agency cleats. But just because I’m an agency doesn’t mean we can’t chat (no charge). Please email me on any topic and I will gladly reply: eyal@mvpgrow.com