Fake news is more than just the scandalous headlines with AI-generated images that your mom shares on Facebook. In 2025, exaggerated claims and overstated narratives are deeply embedded in the venture-backed startup ecosystem.

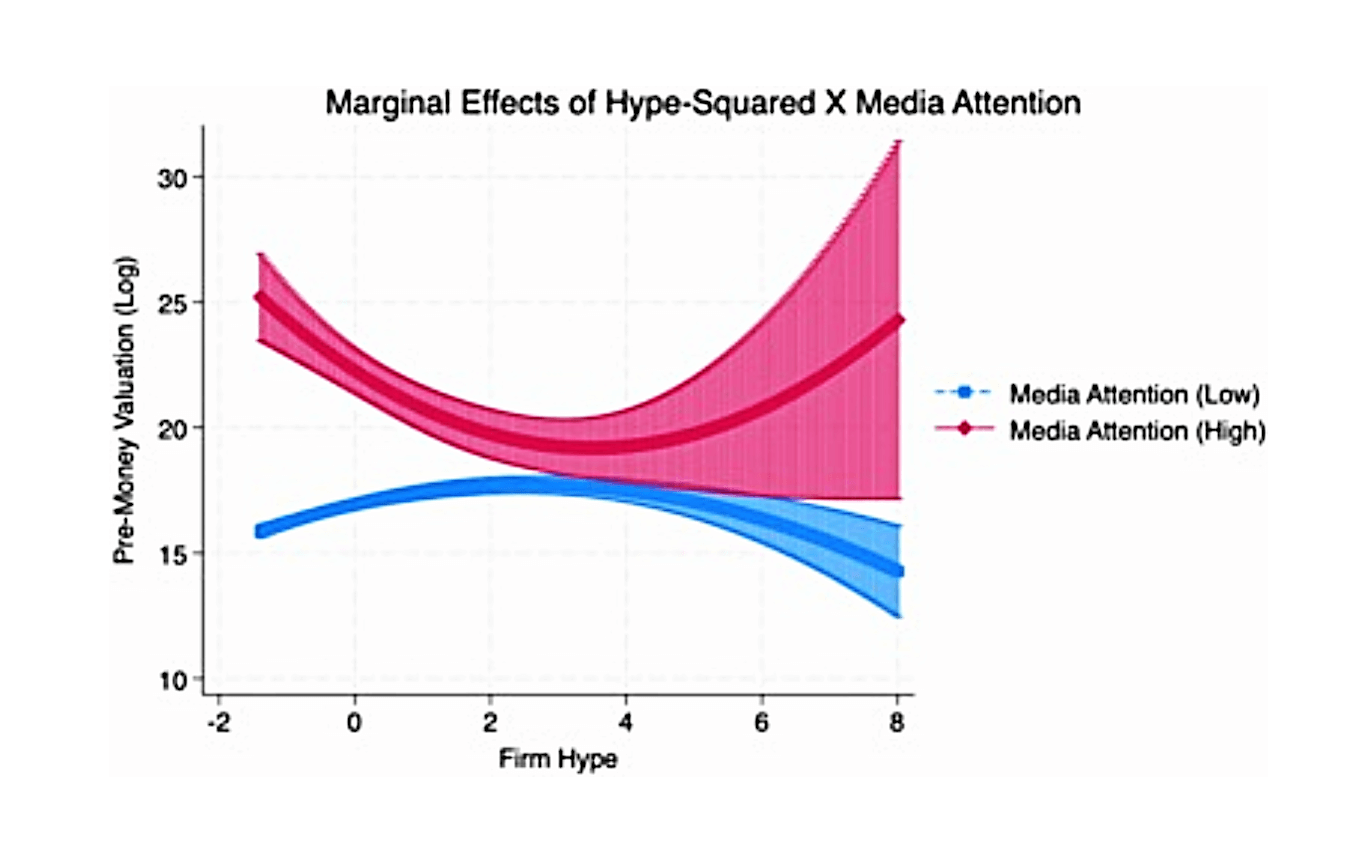

It may seem paradoxical. Why would respected investors embrace misinformation? The answer is unsurprising: because it works. In an ecosystem where attention drives valuation far more than accuracy, misinformation is often quietly enabled or conveniently overlooked. It’s not a bug; it’s a feature that drives engagement, which drives valuation.

Need proof? Consider this real-life scenario of quiet misinformation enablement: Bhavye Khetan, a former University of California, Berkeley computer science student, posted on X about his experience creating a fake founder persona. His persona had no product, no pitch, and no deck, but it included the following fake qualifications: Stanford CS, ex-Palantir, and it used the word “AI” 3 times. He proceeded to send cold emails to 34 VCs. Shockingly, twenty-seven replied, and four asked for a call. Said Khetan, “This game is rigged in ways most people don’t understand.”

The question is, why does unsubstantiated hype thrive in the startup world? And why should you care? Let’s explore the connection between hype, attention, engagement, and revenue.

Fake News Drives Revenues

Sensationalized claims may represent poor ethics but make for undeniably great business. Outrage, surprise, curiosity, and controversy drive clicks, likes, and shares—precisely what the ad-driven user feed algorithms crave. Platforms like X (formerly Twitter) and Facebook (Meta) thrive by amplifying attention-grabbing narratives, creating what some call the “Muskification of media“—a landscape where virality consistently triumphs over factual accuracy.

Why would VCs embrace this risky strategy? It’s simple—higher engagement directly translates to higher valuations, especially in early rounds. Startups like Nate and Builder.ai demonstrated that inflated claims (like fake AI capabilities) can quickly attract millions in VC funding. Even when the truth is eventually revealed, the initial hype can secure enough runway capital to justify the risk.

However, exaggerated claims don’t merely attract attention. They actively undermine traditional media to reshape the market landscape.

The Disruption of Traditional Media

Traditional media has been in decline for several years now. Media channels that are regulated and held accountable for disinformation are struggling to remain profitable and retain their audiences. Ironically, this trust vacuum creates fertile ground for startups that position themselves as disruptive alternatives, often with VC backing.

Many VCs are eager to invest in fresh media players precisely because chaos and doubt serve as entry points to market dominance. When audiences lose faith in reputable outlets, they’re more likely to turn to newer, edgier platforms that serve clickbait headlines rather than verified facts.

Destabilizing established media becomes a strategic advantage. Startups that intelligently leverage controversy and unsubstantiated hype effectively destabilize traditional media’s authority, creating space for rapid growth and potentially lucrative exits.

As trust in legacy media fades, audiences become fragmented and polarized. While propaganda-driven alt-social media platforms like Truth Social illustrate extreme polarization, the startup ecosystem exploits these dynamics differently by viewing polarization primarily as an opportunity for targeted monetization.

Monetizing Polarization

Politicians and religious leaders have been capitalizing on social polarization for centuries. Now, startups are also cashing in. Audiences fragment into tribes that exist in echo chambers, where they become deeply engaged and fiercely loyal to their tribe’s ideals.

For startups, these tribes become revenue segments targeted with subscriptions, niche content, or products, such as Substack newsletters, Daily Wire+ media bundles, and influencer-backed merchandise.

Polarization isn’t just a byproduct of shifting media consumption preferences but a deliberate growth strategy. And it works, too—a recent study confirms that social platforms actively encourage echo chambers, which boosts their revenues by dividing users along ideological lines.

VCs understand the value of these highly engaged communities in generating revenues driven by recurring and consistent engagement. The greater the controversy, the “stickier” the audience gets. Conveniently, this also benefits data-hungry investors who seek insights into consumers’ minds by collecting richer data about their needs, fears, triggers, and biases.

Data and Behavioral Targeting

Misinformation doesn’t just provoke emotional reactions. It reveals emotional patterns that can be tracked, segmented, and monetized. Every click on a sensational headline and every heated comment shared offers valuable insight into users’ deepest biases, preconceptions, and triggers. For VCs and the startups they back, this behavioral data is a goldmine that fuels targeted advertising and AI model training—areas where VC funding is abundant.

Emotion-driven content, even when inflated or misleading, yields richer insights than neutral, carefully vetted stories. For venture-backed platform startups that harness controversy, this means increased revenue streams. They don’t only monetize engagement and optimize ad targeting; they capitalize on the insights derived from user actions and reactions.

This data-driven feedback loop makes misinformation a profitable investment. Achieving virality with misinformation is cheap, while the data and insights deliver significant monetary value. For VCs, this formula is almost irresistible.

The Low Cost of High Virality

Producing accurate, valuable, and insightful content takes time, expertise, and money. Fake news, on the other hand, is incredibly cheap to create, especially in an era of widespread misleading AI-generated content. Misinformation requires minimal to no fact-checking, supports rapid publishing cycles, and generates immediate algorithmic feedback.

AI accelerates this dynamic. A single LLM can generate hundreds of clickbait posts in minutes. Meanwhile, fact-checking is slow, expensive, and manual. The economics heavily favor scale over accuracy.

For startups looking to prove traction, misinformation is an unbeatable cheat code: apparent rapid growth at negligible costs. For VCs chasing quick wins, this spells opportunity. Ethical concerns are often overlooked when engagement metrics surge and valuations skyrocket. After all, moral standards are not what VCs are measured by. Profits are. While reputable VCs may not openly fund misinformation, they eagerly invest in the infrastructure that enables it.

VCs Back the Infrastructure That Enables Fake News

Social networks like X, Reddit, and Meta are venture-funded vehicles built to drive virality. Similarly, some deepfake generative AI startups responsible for producing misinformation content at an unprecedented scale have seen hundreds of millions poured into their growth. Ironically enough, startups designed to counter misinformation, like Refute, are funded by the very investors who indirectly benefit from the mayhem.

For VCs, backing the tools that amplify content (whether true or false) is a strategic investment. It’s based on a relatively simple equation: more content means more engagement, more data, and, ultimately, more profit. This infrastructure doesn’t merely amplify misinformation. It facilitates an even sneakier deception: the illusion of explosive growth.

Misleading Narratives and “Fake Growth”

Startups live or die by growth narratives. But real growth and actual traction are hard to come by. Sometimes startups outright lie. Inflated user numbers, exaggerated traction, and fabricated competing VC term sheets have become disturbingly common.

High-profile cases such as Frank, whose founder inflated user numbers by millions to secure a $175 million acquisition, and IRL, which admitted 95% of its supposed users were fake, highlight how prevalent these tactics are. VCs often overlook such deception, knowingly or not, as long as the narrative appears credible enough to secure the next funding round or lucrative exit.

Here’s the simple but uncomfortable truth: if it looks like momentum, that’s often good enough for investors. The real ethical dilemma isn’t that deception happens. The issue is that the VC ecosystem itself incentivizes looking the other way.

Fake News: Incentives and Ethical Blind Spots

When you measure success in months rather than decades, as VCs do, speed and scale naturally take priority over things like accuracy and ethics. Responsible, steady business growth doesn’t turn tech journalists’ heads or lead to explosive headline-making exits.

Startups quickly learned to play the game. They realized that cautious honesty and transparency don’t impress VCs seeking hyper-growth nearly as much as bold claims and eye-catching metrics, even when skewed and exaggerated (if not entirely fabricated).

VCs aren’t naïve. Many of them knowingly choose to overlook the ethical gray areas if the potential payoff is sufficiently compelling. Venture capitalists often “don’t let facts get in the way” of a good investment story (even if it’s fake news) because it’s profitable.

The Profitable Logic of Misinformation

Exaggerated claims and inflated narratives thrive because venture capital structurally rewards attention, engagement, and rapid growth above accuracy and ethics. Investors don’t need to explicitly promote misinformation to profit; they merely fund ecosystems that amplify sensationalism, polarization, and surface-level hype.

Until the core incentives within venture capital evolve to prioritize substance over sensationalism, unsubstantiated hype will continue to be profitable. Sadly, in the current attention-driven market, truth remains optional—while profitability is mandatory.

The Founder & Chief Getting Sh%T Done Officer of mvpGrow. After about 8 years as a hired hand some of the largest (and smallest) B2B SaaS companies worldwide I decided to hang up my employee slippers and lace up my growth agency cleats. But just because I’m an agency doesn’t mean we can’t chat (no charge). Please email me on any topic and I will gladly reply: eyal@mvpgrow.com